Times Of India

What is the good news for the denizens who have been embraced into Greater Bangalore? That there is no increase in any taxes in the near future.

At least that’s the first indication government officials are sending out. Major issues that the citizenry are worried about — betterment charges, levying new cesses — have still not been spelt out. “Give us a few more weeks, everything will be spelt out,” say officials. The administrative challenges still remain — how many offices, staff strength, uniform taxation system and merger. The status quo — existing offices will continue at the CMCs, TMC and village panchayats. Until notified further, these citizens have to continue paying taxes, cesses and get their khata from the existing offices.

Here’s what is being promised as well — that from every residence, there will be an office within 3-4 km, where basic administration work for the citizens can be handled. To start with, the existing 3 zones will escalate to 8 zones and each zone will have 4 offices.

Officials say that it’s only from the next financial year that all the citizens coming under the jurisdiction of 741 sq km of Greater Bangalore, will be treated under a new banner, with a uniform adminsitration for the entire jurisdiction.

Boundary for Greater Bangalore

In the north, the boundary starts from the junction of Govindapura and Vaderapura. The boundary is co-terminus with the northern boundary of Vaderapura running in eastern direction. The boundary again touches the junction of Kattigenahalli, Kogilu and Bellahalli. The boundary further covers the northern and eastern limits of Belahalli running towards south, along the eastern limits of villages.

The boundary runs southwards encompassing Medahalli (of K R Puram CMC). The boundary traverses westwards along the southern boundary of villages Basapura, Begur, Yelenahalli, Kambathenahalli encompassing the village Basavanapura, Gottigere. From the junction of Nagadevanahalli (of Kengeri CMC) and Sonnenahalli, the boundary moves towards the north along the boundary and encompasses villages — Sonnenahalli, Ullalu, Herohalli, Siddelehalli.

From the junction of Lakshmipura, Singapura (of Byatarayanapura CMC) Chikkabettahalli, the boundary runs towards the north, covers villages Chikkabettahalli, Doddabettahalli, Atturu (of Yelahanka CMC), Ananthapura and Harohalli villages.

Registration of properties

The final notification on Greater Bangalore has come at a time when the registration of properties is in a limbo. While the CMC/TMC (which is now dissolved) and 111 villages of various grama panchayats, which have now come under the aegis of Bruhat Bangalore Mahanagara Palike (BBMP), will have to wait as the state has not issued any clear guidelines on the status of properties that are now part of Bangalore agglomerate. According to official sources, it will take a while for the BMP to update property records in erstwhile CMC/TMC areas and issue khata under the BBMP banner. Until then, property registrations in these areas will continue to be in a mess.

Currently, only properties in BMP jurisdiction with the Palike issued khata, those allotted by BDA and layouts approved by BDA, properties allotted by Karnataka Housing Board, KIADB and KSSIDC are being registered.

“Once the urban local bodies come under the BBMP, khatas issued by the CMC/TMC/gram panchayat will have to be updated by the BBMP officials within one year. Only then the properties can be registered,” officials of the stamps and registration department explained to The Times of India.

Properties in CMC/TMC areas, which have khatas will be valid till the next financial year. However, revenue properties will be banned from registration as they are agricultural non-converted lands.

Meanwhile, the property value in the city outskirts has seen a 10 to 15 per cent increase ever since the preliminary notification of Greater Bangalore. Property developers too are holding back their assets till the government comes up with a clear policy on the issue. “We have identified land in CMC areas and finalised the deal. But we do not want to register as there will be administrative wrangles later. We have paid the owner and will do the transaction when Greater Bangalore takes shape,” said a few developers.

CM plans out elections

With Greater Bangalore being notified, the state is looking at the next step: setting up an elected body to govern it. CM H D Kumaraswamy on Wednesday said: “As soon as reservation and delimitation of constituencies are done, we will take up the elections.”

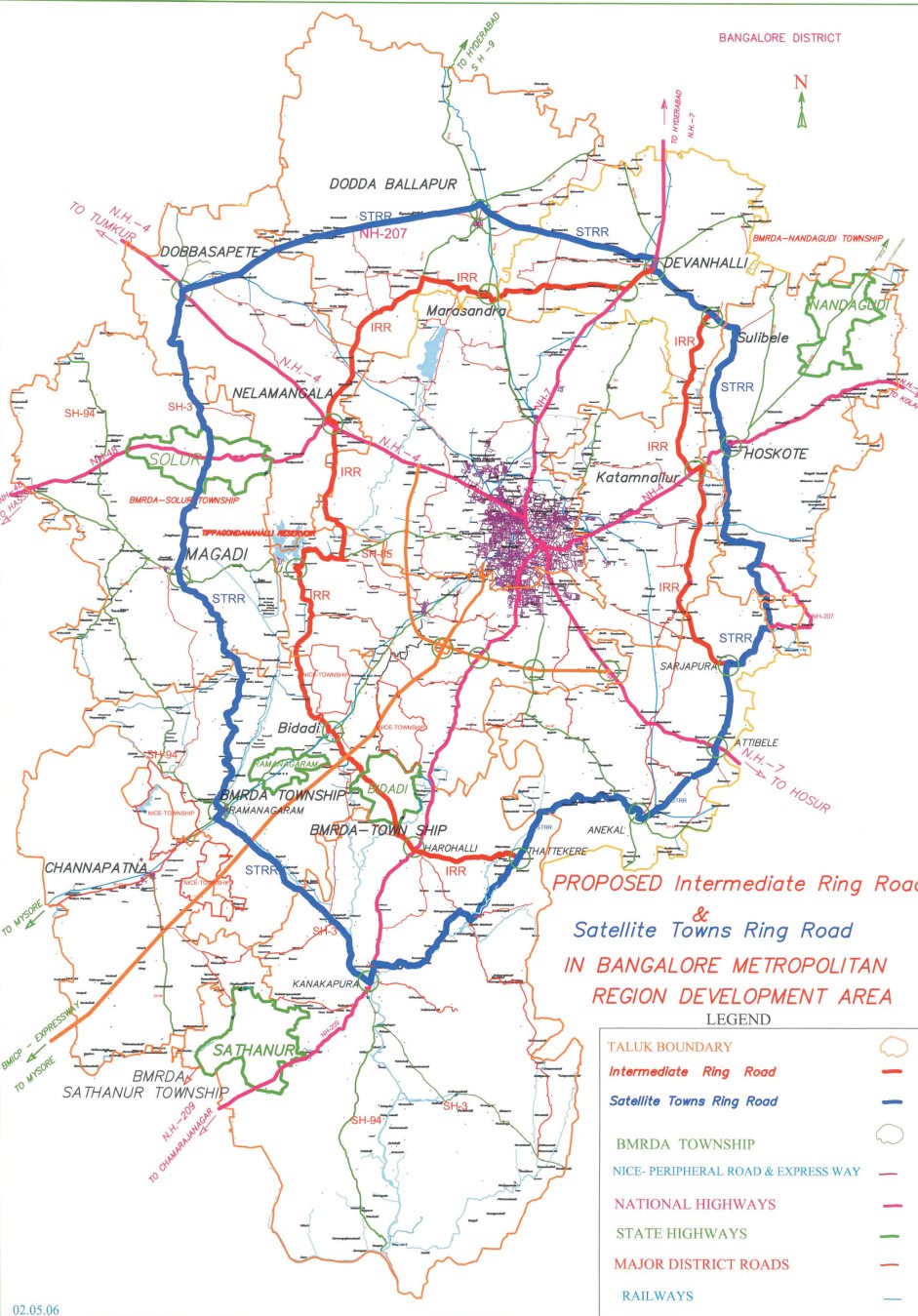

Kumaraswamy firm on Bidadi township

The Hindu

Says farmers will get a fair compensation

# 9,000 acres of land to be acquired

# 32 bidders offer to develop the township

BANGALORE: The State Government will hold discussion with farmers and provide a good compensation package for those who stand to lose land for the proposed satellite township in Bidadi, 35 km from Bangalore, Chief Minister H.D. Kumaraswamy has said.

The Government had decided to acquire over 9,000-acre land in several villages to establish the township at Bidadi in Ramanagaram Assembly Constituency, which is represented by Chief Minister himself.

Says farmers will get a fair compensation

# 9,000 acres of land to be acquired

# 32 bidders offer to develop the township

BANGALORE: The State Government will hold discussion with farmers and provide a good compensation package for those who stand to lose land for the proposed satellite township in Bidadi, 35 km from Bangalore, Chief Minister H.D. Kumaraswamy has said.

The Government had decided to acquire over 9,000-acre land in several villages to establish the township at Bidadi in Ramanagaram Assembly Constituency, which is represented by Chief Minister himself.