It appears that a 15% decline in the rupee has lead to surge in NRI interest in property. While the rest of Indian economy slows down the NRI can sustain micromarkets in IT cities like Bangalore, Pune and Chennai

DNA Article followed by one in Times of India. The builders are in overdrive mode courting the NRI.

DNA Article followed by one in Times of India. The builders are in overdrive mode courting the NRI.

The record decline in the value of the Indian rupee and the sluggish realty market have proved to be a double delight for overseas Indians investing in property here.

Sunil Sequira, a resident of Kuwait, has zeroed in on a property in Thane at a rate nearly 30% lower than usual. “This is the right time to buy property,” he said. “Many of my friends have also decided to buy property in India. We are expecting an annual 10% to 15% appreciation.”

Sandeep Reddy, co-founder of Groff.com, a real estate brokerage firm, said it has been getting a good response from overseas buyers. At the recent property exhibition in Dubai, many people booked flats on the spot, and several showed interest in flying to Mumbai to check out property and finalise their decisions.

“NRIs are mainly interested in Navi Mumbai and Bangalore properties. This time, there was a slightly lower demand for the Delhi market. Going by this response, we have decided to organise and participate in exhibitions in Singapore and other international places that have a large Indian population,” said Reddy.

Niranjan Hiranandani, managing director of the Hiranandani Group, said, “The decline in the rupee value against the dollar/dinar in the international market has helped to attract more and more NRI buyers. If the cost of the flat is Rs1 crore as per the Indian market, the NRI has to pay only Rs85 lakh— 15% less, thanks to the record decline in the rupee value.”

Commercial opportunities in the West are on a downturn. So, people are looking at the Indian market for investment and business purposes, he added. “Once the RBI brings down its high interest rate, the city property market will surge again. There is a huge demand for houses, but the high costs and interest rates have discouraged buyers temporarily. People are awaiting the low interest rate loan.”

Times of India article

Hot Indian property destinations for NRIs in 2012

The Non Resident Indian (NRI) might as well remember 2011 as the year of the 'lazy investor'. For NRIs have gained 18% since August 2011, simply by remitting money to India; no effort at all. But as we approach 2012, NRIs must take stock of how best to use their remittances. The traditional favorite has always been real estate. But in this volatile market, how great an investment is it? Is this a good time to buy property in India? What kind of property is a good bet? Let's try to find answers.

Times of India article

Hot Indian property destinations for NRIs in 2012

The Non Resident Indian (NRI) might as well remember 2011 as the year of the 'lazy investor'. For NRIs have gained 18% since August 2011, simply by remitting money to India; no effort at all. But as we approach 2012, NRIs must take stock of how best to use their remittances. The traditional favorite has always been real estate. But in this volatile market, how great an investment is it? Is this a good time to buy property in India? What kind of property is a good bet? Let's try to find answers.

What are the key locations for residential property?

"Suburban locations of every metro are great investment options. So for instance, you have Gandhinagar near Ahmedabad, Nalasopara, Dahisar, Panvel, Pen and Kalamboli near Mumbai," says Dutt.

Mahtani places her bets on GST road, Porur and OMR in Chennai, North Bangalore largely Hibbal, Saha Shivnagar, Sarjapur Road and Whitefield in Bangalore, Dwarka Expressway in Gurgaon, Bandra East, Goregaon, Panvel in Mumbai and certain select developments in Lower parel, Mahalaxmi and Parel in Central Mumbai.

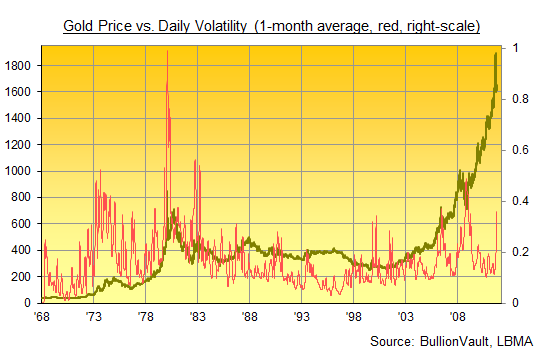

(courtesy Bullion Vault)

(courtesy Bullion Vault)