Property

BRICS other than India

- http://www.marketwatch.com/story/property-gloom-deepens-as-china-holiday-ends-2011-10-07

- http://in.reuters.com/article/2011/10/09/idINIndia-59759220111009

- http://www.time.com/time/magazine/article/0,9171,2096345,00.html

- http://brazil.homesgofast.com/news/seven-brazilian-cities-seven-real-estate-rises-I2303/

- http://rbth.ru/articles/2011/10/05/bricks_and_mortar_back_to_the_bubble_13538.html

- http://housepricesouthafrica.com/graphs/

- http://www.brazilianbubble.com/

Non Brics

- Canada http://www.canadianrealestatemagazine.ca/news/item/828-bubble-talk-on-the-rise-in-canada

- http://thehousingbubbleblog.com/?m=20111007

Other bubbles

- Commodites http://www.economonitor.com/lrwray/2011/09/27/is-the-commodities-bubble-a-case-of-index-speculation-by-money-managers/

- Chinese internet and Tech bubble http://www.forbes.com/sites/panosmourdoukoutas/2011/09/30/the-chinese-internet-bubble-is-busting/

- Indian Internet bubble http://www.businessinsider.com/india-tech-reaches-near-bubble-stage-2011-10

- US bubble #3 - Groupon, Facebook, Netflix. Google, Twitter, Zillow, Zynga, No comments on this http://www.theregister.co.uk/2011/09/20/bubbles_and_silicon_valley

- http://www.nytimes.com/2011/10/10/business/global/households-pay-a-price-for-chinas-growth.html?ref=world

Developed world economy - Lost decade(s) looming

- Back To Mesopotamia http://www.bcg.com/documents/file87307.pdf

- http://www.zerohedge.com/news/muddle-through-has-failed-bcg-says-there-may-be-only-painful-ways-out-crisis

- Merkozy and the Greek tragedy http://www.telegraph.co.uk/finance/financialcrisis/8782663/Debt-crisis-live.html

Fresh bout of gloom and doom. Remember the last time the world was in this rut was in 1937 and it took a world war to come out of it ...

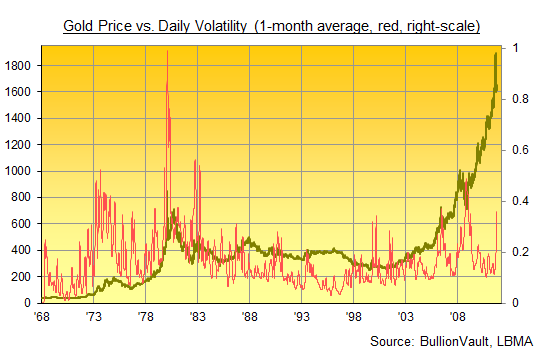

Gold price over the decades

USD INR

(courtesy Bullion Vault)

(courtesy Bullion Vault)

103 comments:

buy one get one free in china. Cant wait to see the smirks wiped off the realty rich idiots in india.

http://www.macrobusiness.com.au/2011/10/china-realty-goes-bogof/

Property in India. Get the best deals on India property deals and other services of sale, buy and rent.

Baba, there is no real estate bubble in India. It is all demand and supply. In Mumbai Western suburbs, no flats available for resale and the prices are 10-20% above market rate.

This is all chamatkar of 'Black Paisa'

Dont draw graphs and cut and paste from magazines to fool people

Lpawar,

You are right. There is no bubble. It is all organic growth. Go ahead and buy more, and especially you should buy more as you are very optimistic. Jab danda lagega na peeche, to nani yaad aayegi. Let's see how much printing can really go on and for how many more years.

I'll never buy for the next 10 years probably and be a happy renter renting for a fraction of the price.

LPawar,

The demand is all speculative. If the demand was real, the rents would also go up.

You learned only the demand supply words from economics but didn't read the whole econ book. Looks like you are a RE pimp.

BTW, risk taking punters on this blog may also consider investing in the Greek 1-year bond. Its yield is now 151.2% !!

"Cant wait to see the smirks wiped off the realty rich idiots in india."

There is a ton of unearned wealth in India and insanely wealthy people who got that way without having to expend any real effort. Once the RE bubble bursts, all that phony wealth is going to go the way of the dodo bird.

Step back and stand well clear. When the horse manure hits the fan, it ain't going to look pretty.

Lpawar,

Even if Demand exceeds supply doesnt mean there is no bubble. It just means the bubble became a mania and expected to turn into panic at some point.

A lot of people need education in history not current affairs.

@Lpawar:

You will get lot of traffic for your post.

"Baba, there is no real estate bubble in India. It is all demand and supply. In Mumbai Western suburbs, no flats available for resale and the prices are 10-20% above market rate."

Ofcourse, Indians do not sell anything for loss.. in other words, they do not sell real estate in reality. It is asset to keep with them forever.

"This is all chamatkar of 'Black Paisa'"

Truth spoken.

"Dont draw graphs and cut and paste from magazines to fool people"

Wrong. These are data graph, one can reach to their own decision with these data. Opinion and advice are completely different things.

Every commodity in India has become expensive. If you compare 2001 to 2011, the prices have gone up by 10 fold. Income/salary has gone up proportionally. During this 10 years real estate has gone up by max 3 times.

So why this hullabaloo about real estate. In my opinion real estate is under priced in major cities like Mumbai. The problem faced by many people is the availability. The builders dont make much profit. The only gain is the black money that is non taxable.

You guys are living in fools paradise♠ . you guys expect to buy a mercedez for 5 lakhs and curse the dealer when he mentions the price

Wake up to reality , Pawar, in my opinion has a point. Western examples/happening have twisted your minds

P. W. Rane, Dadar W, Mumbai

rane , Hilarious post.

Folks he got a point too in the sense, till shit hits the fan it doesn't.

The bearish people in india, I know think the prices will go continue to go up, only the rate of change will be more moderate like 10%.

I am firmly in the dont spend a dollar buying anything in India camp.but I have been there from 2007 and a lot of people made shit loads of money buying and selling property since then.There were nice trades that some people took advantage of, stupid or not successful trade is successful trade.

As long as property market is high there always be demand in city like Mumbai. Also it is not just black money behind such steady demand. There are many peple in the city on their way to buy 3rd/ 4th flat. Every member of the such people of family of 4 or 5 earns decent income. There will not be dearth of demand for flats.

People are not to be blamed. Like in the USA/UK they have not seen or witnessed how bad realty could go. They have not heard horror stories of foreclosures or job losses.

The fact is, people have money and they are greedy. Even if they own 10 flats, they will go for 11th.

It is very difficult to say what and when prices will reach saturation point. Question is , would there be any saturation point in Mumbai.

Some very good sites:

http://globaleconomicanalysis.blogspot.com

http://www.irvinehousingblog.com

http://piggington.com/

http://calculatedriskblog.com

http://chovanec.wordpress.com

http://www.nakedcapitalism.com

Thanks Anand! very helpful.

For all you experts out there, here is a question. If I want to get out of the cesspool cities of Bombay and Bangalore and go to a quiet town in India, that has reasonable infrastructure and value for money in terms of real estate, which city would you recommend, and why?

Thanks!!

@Anon - "If you compare 2001 to 2011, the prices have gone up by 10 fold "

Hardly true (atleast of the IT industry). Infy, Wipro, TCS used to pay freshers about 15k/month in 1999 - i.e. 1.8L a year. Now they pay about 4L per year. This equates to around 8% pa growth. Mostly inline with inflation. Same is true for managerial roles as well. Positions paying 9-10L then now pay about 20L.

I cant speak for the other industries, but in all likelihood the numbers will be similar.

From the macrobusiness.com.au blog, see this video - http://www.youtube.com/watch?v=tJB4frVnilQ .

In some ways our cities are similar. At current prices, Mumbai reportedly has 6 years of inventory for sale !!

I cant speak for the other industries, but in all likelihood the numbers will be similar.

That is true but then there are people whose salary has gone up more than that. Someone who was a fresher at 1.8L in 2000 is a manager at 20L in 2010 so his salary is up 10 times.

As long as there is enough demand from managers and front-running speculators, no one will build for the fresher. If Tata could sell JLR in India, would they care to build Nano? So the time for RE-Nano will come once everyone who wants to and can afford the RE-JLR has bought or has been priced out and the speculators have realized there is no more money to be made in RE and they go hunting for the next bubble.

@Pawan - "Someone who was a fresher at 1.8L in 2000 is a manager at 20L in 2010 so his salary is up 10 times"

You cant compare two different positions and say salaries have gone up. In real terms, salaries have been relatively flat even for managers.

What has increased is the number of managers. The industry has grown and so the number of people in high paying roles has increased. Whether this justifies the asset price increase, time will tell. The price-rent ratios indicate a bubble though.

For every reason for bullish scenario, other will find more reason to shoot it down who think its expensive. But the fact remains that for bull market no negative news is negative news and small positive news is a big positive news. So as long as real estate is in bull phase, no research or analysis will support that it’s a bubble zone. Anyways, I was just reading one small article today in ET and found that small 10x10 place near Mumbai airport slum going at 40 to 50 lakhs. That’s the fact of the life, so as long as the demand is fuelling from bottom of the pyramid, the price and jump will sustain. Very hard to digest isn’t it? Imagine small slum dweller comes to good building and becomes the neighbor. This is happening I have seen and not in small numbers in a big way. In Malad goregaon old chawl residents are getting one crore for vacating the house. And they are buying in good locations such as Hiranandani or SV Road, Link Road etc. This is upward migration is also supporting the current price.

Also on price rent ratio, my two cents.. Why unilever or any FMCG, Pharma company trades premium to other even though from dividend yield perspective there may be far better other stocks. But the investors don’t buy for dividend yield everybody knows that, they buy for safety and capital gain. The same goes for the real estate, the price will be always in forward curve. In India real estate is always expensive in metros from the day of independence, the problem is that we are looking now in absolute terms such as 50 lakhs, one crore and so on. In relative terms that may not be a true value and that may be less. The equity market returns in last 10 years in IT or Infra or banking stocks from 2001, they all have gone minimum 10 times, so why can’t real estate goes beyond 10 times. May be its unaffordable today, but it’s in a bubble zone, I doubt!

I've been flat hunting for the last two years in western suburbs. What i've come across is steady increase in prices everywhere. Some wretched places , the price increases have been in the vicinity of +500 rs/sqft.

I've also observed that builders/their agents also want to know about your background, religious beliefs, academic qualification before any serious negotiation. This has been very frustrating. I specially dont understand that what a persons background has to do with builder. I can understand co-op society making such inquiry but builder or his agent trying to probe is outlandish.

Bye the way, I belong to the majority religion but what is hindering my case, seems to be that I an from north.

I guess that the builders can be so selective because of high demand or there has been some political pressure from govt. A similar situation also is faced by some of my acquaintances.

In all, I've been very frustrated

@Above Bhayya,

No need to get frustrated. Builders may be cautious selling property to people who normally like to shit and urinate in public places, so that any such sale would hinder further sales.

I suggest that you should seriously think of shifting to varanasi or Lucknow where people will accept you

Moneylife Magazine's latest issue talks of a prospect of property bust. Imagine that Lias Foras - the property consultant saying that there is 40 months inventory for residences in Mumbai! That is a big change in tone if there ever was. MCHI property expo was held at BKC in Mumbai. Any idea of the response in terms of actual property bookings? Very little ready possession properties were available.

@anon - "But the investors don’t buy for dividend yield everybody knows that, they buy for safety and capital gain. "

The classic sign of a bubble - people looking for capital gains without worrying about earnings.

Tulip, south sea, mississippi bubbles, Japanese RE/Stock, Dotcom, Scandinavian RE in early 90s, US/UK/Ireland/Spain/AU - every single one of these bubbles has been characterized by a frenzy for capital gains when the underlying earnings simply did not support the expectations and in some cases did not exist even.

Cue next comment on how this time is different and India is different :)

I sincerely like your optimism guys. But sorry to say, its completely wrong.

If US faces recession, sustained one, for an year at least then and only then RE in India can come down. If IT jobs in India are secure or appear to be secure, forget about fall; there would not be even a small correction. I don’t think US will go in recession; check the job data and many other indicators. The thing which goes up for no reason; can’t come down without a solid reason. Why can’t you guys apply a simple logic? Robert Vadra bhai has put loads of money in RE recently. You know who he is; is he fool to put his money in RE? Do you think he has taken such decision without any assurance from GOI? Will they allow his money getting in vain so easily?

And for god’s sake, don’t reply back with slang, don’t take out your frustration this way. RE prices won’t fall if you call me pimp or chu*.

Anon above.

Outsourcing from USA is to stay. Because American corporates like cheap labor. Americans don't want to cut back on their many luxuries that they are used to, hence will not compete with cheap labor, all they can do is occupy wall street.

Many immigrants goto USA and make solid wealth in 5 years time frame starting from ground zero. Ofcourse it requires lots of sacrifice, hard work. No free handouts.

Ask American if he can live without his 'iPhone'.

Are properties in mumbai Insured? If there is a natural calamity or fire or riots or any such incident, do people normally insure their property or are you SOL?

"India’s housing markets surged in Q2 2011. There were amazingly strong house price increases, despite an economic slowdown which saw gross domestic product grow by ‘only’ 7.7% during the year to Q2 2011"

House prices rose in almost all major cities in India from Q1 to Q2 2011. There were astonishing price hikes in Bhopal (34.13% on a quarter-on-quarter basis), Faridabad (33.33%) and Kochi (24.42%), according to NHB figures –)."

http://www.nuwireinvestor.com/articles/prices-surge-in-indian-housing-market-57901.aspx

So much for the bursting of the bubble.

@Above blogger

You proved my point. People are brainwashed by western economic models are making 'BakBak' here. We will take at least 100 years to reach the level of sick Greece (per capita $28000). People with white paisa are living hand to mouth in India where as those with black paisa buying real estate, mercedez, bmw etc

Flat prices may remain stagnant while anti corruption fight is going on, but rise once the fizz is let out as those fighting anti corruption are also corrupt.

L Pawar

Pawar, I'm not sure who are you trying to convince. If you are so sure, why are you even here. Go and buy and be happy. Buy as many as you can. Good for you.

Pawar,

Per capita of Greece is 28K as you said but the home prices are 50% lower than India.

You can now understand the extent of bubble in India. Use your brains. Even at a very per capita income, Indian RE is double the price than Greece. Is it sustainable? Is UPA sustainable? Is greed and corruption sustainable?

Can you tell me if your child when he/she starts working can even think about buying a house all his life? This corrupt generation is ruining future of our kids, borrowing from them and spending now. You have to have vision and not just lust for money and unconvincing ideas.

Per capita of Greece is 28K as you said but the home prices are 50% lower than India.

What is the average home price in India? When you talk per capita you include those 40Cr. people who earn less than a dollar a day but when it comes to taking the average home price then you only want to look at the metros.

What is the population of Greece? 1.1 Cr. India has more number of crorepatis than that.

Pawan,

US also has that many crorepati's and I would say 50% USA is crorepati as $200K is average RE price there. USA is going through a major correction.

It is not about Greece or US or India. The values have to rise based on fundamentals. What would happen when banks in India really freak out as they are under massive debt?

Buy, BUY, Buy...make the bubble even bigger. Bigger it gets louder would be the noise.

My last few comments have not been published at all - very strange

@Vik is there a moderation set somewhere -

By the way again I ask - how do you decide what the peak price was?

Example - builder launches project priced 60 lakh per unit and sells about 25% units

Then prices are jacked up to 1.2 crore but sells zero units

Then he reduces to 80 lakh and sells 25% units.

Q1) is this drop of 40 lakh or increase of 60 lakh ??

If his margin was 45% on whole project (which is entirely possible in India if land was bought by bribes) he has broken even (repaid loans) given this scenario many builders have ample time to get the next bakra for his remaining 50%. Most small builders operate this way and can wait out for the next black moneyer to buy the property (or bail them out)

Most large builders however have land banks mortgaged to the banks/fin. institutions/investors/ stock market for funding. In those cases the pain of the bubble will be decided by the leverage and scale of sellable houses made v/s land bank.

Given the fact that government bails out the fin. institutions backing big builders and black money folk bail out small builders I honestly doubt prices of "fully ready" housing properties will ever fall.

Land prices however might collapse but time will tell when it does what course of action will be taken - does GoI bail the bankers from insolvency? the collapsed stock market will provide huge buying opportunity for FIIs so basically they might bail out the losing party too. Wait and watch and buy only if you are getting ready possession and want to live there

* increase of 20 lakh?

China in trouble for sure -

http://www.telegraph.co.uk/finance/china-business/8821094/Chinas-debt-spree-returns-to-haunt.html

Question for the RE bears. Don't you feel FOOLISH when you read stories like this:

http://www.nuwireinvestor.com/articles/prices-surge-in-indian-housing-market-57901.aspx

@skeptic optimist,

What has china has to do with India. Stop quoting foreign countries and dwell on desi topics.

China is communist. Corrupt firing squad if caught. We are different. We worship corrupt people.

I have stopped believing in bubble but not given up hope of acquiring a home of my own. There are many ways that one can earn real money and hopefully Bhagwan will direct to me a right corrupt business

Sk Gh:

You mentioned many times that GOI will bailout the banks and biggies. Fine, they would try. But do you know how would they get this much money to bail out other than printing more money?

If India keeps printing, rupee would soon be trash, aaloo, pyaaz would be 1000 rupees/kg. Good, india would inflate its way but at what cost? They would get no loans for their debt and borrowings. It will get downgraded the next day the crisis comes. It would be a self fulfilling prophecy unlike US that bailouts didn;t do any magic to RE prices.

Why US could do bailous and can still do: USD is world reserve currency and they enjoy this status. They can do whatever but not other countries.

Anon @12:23

China's sound economy has to do a lot for India's survival. If China goes down, it will take down major economies like Australia, Canada and all of South Asia for a decade.

Get your head out of your arse and think globally.

Skeptics ghost,

Might be a blogger issue. No moderation unless foul language is used

"Might be a blogger issue. No moderation unless foul language is used"

Vik, the common issues I've noted is that blogger does not sometimes like usage of special symbols like "@", # or some of the "'s used in profiles other than English (US).

Also, too long paragraphs are a no no.

Also, if you are cutting and pasting from WORD or other rich-text formats, you may have a problem. It is better to cut and paste to Notepad first before copying to the board.

@Anon - "Don't you feel FOOLISH when you read stories like this: "

Not really, when I see this .

Mumbai - yields are poor, at 2.52% to 2.76%.

Delhi - at 1.71% to 2%.

Go ahead, be my guest and chase the capital gains.

China's sound economy has to do a lot for India's survival. If China goes down, it will take down major economies like Australia, Canada and all of South Asia for a decade.

It would just be the other way around for India. If China falls, commodities and crude will fall down bringing down inflation and that would be a huge stimulus for Indian domestic consumption.

GSM:

The commodities bubble is not driven by China alone. Look at the prices of Corn, Wheat and even Gold.

Moreover, the commodities bubble will burst with China bursting or not. It is a matter of time. It will in fact hurt India's exports. As far as Oil is concerned, it would stay around $80 or higher for a long time. There would be no respite in terms of crude. And rupee will also depreciate further which will make all imports including crude expensive in India. Which means more inflation, more rate hikes and slower growth.

Most bloggers here are a confused lot. They are comparing foreign countries with India and drawing unnecessary conclusions.

Recession, export/import, price rises are a reality, but mostly affect the poor and lower middle classes of India. This is not going to affect rich and upper middle classes, so are rise in real estate prices. Poor and lower middle classes are destined to live in chals or slums. Just because someone gets education doesn't mean that he can equate himself to rich people. Rich people will see that this is going to be maintained. This is our culture.

If you really want to get away from lower strata, earn money by hook or crook. No use in blabbering about china, canada, australia , germany

What is definition of Rich, Middle Class, Poor ?

What do you expect real estate prices in next 5 years, 10 years and 15 years?

What do you expect rise in earnings in percent and average amount for rich, middle and poor class?

Please do not blabber in general terms, be specific and confident.

Enjoy... India and many so called developing countries - inflation therefore growth for rich will go up. Why?

Fed leaves door open on QE3

http://money.cnn.com/2011/10/12/news/economy/federal_reserve_minutes/index.htm?iid=HP_LN

Enjoy again. Happy times for Indians.

Rs 1,700 cr Diwali gift for exporters

http://www.samachar.com/Rs-1700-cr-Diwali-gift-for-exporters-lknpM3aagff.html?utm_source=financial_express&utm_medium=web&utm_campaign=samachar_homepage

Sorry above broken link. Here it is again (Hope it comes up OK this time).

Rs 1,700 cr Diwali gift for exporters

http://www.samachar.com/Rs-1700-cr-Diwali-gift-for-exporters-lknpM3aagff.html?utm_source=financial_express&utm_medium=web&utm_campaign=samachar_homepage

Real estate prices never go down in India. Only up. Look at what's happening in the world right now. Everything is going to hell in a handbasket (US, Eurozone, commodities, etc.). Yet, Indian RE prices are stronger than ever.

Buy now or FOREVER be left out.

You have been warned...

"never go down"

What is your analysis and justification for that?

I repeat:

What do you expect real estate prices in next 5 years, 10 years and 15 years?

What do you expect rise in earnings in percent and average amount for rich, middle and poor class?

"What is your analysis and justification for that? "

Population boom. Strong secular trend of urban migration. Few safe alternative investment classes available. "Bricks and mortar" safe bet during times of high inflation and money printing. Secular trend of very high asset prices in developing world.

"What do you expect real estate prices in next 5 years, 10 years and 15 years?"

Growth of a minimum of 10-20% annually (compounded). Do the math.

"What do you expect rise in earnings in percent and average amount for rich, middle and poor class?"

Same as above.

Anon Above

Nice Joke..

Replace "Growth" with "Fall" and ur post will not be a joke anymore, it will be factual.

"Population boom. Strong secular trend of urban migration."

This has already been for centuries , then what is so different this time?

""Bricks and mortar" safe bet during times of high inflation and money printing. Secular trend of very high asset prices in developing world."

USA printed so much then why Bricks and mortar trick didn't work?

"Growth of a minimum of 10-20% annually (compounded). Do the math. "

I got scared when I did math, looks like you got erection.

"Same as above for earnings"

HAHA... Would you give raise to your maids aka servants raise of 20% per annum? today Rs 1000 and next year Rs. 1200. alternately did you give them last year raise 20%?

Got it?

HAHA... Would you give raise to your maids aka servants raise of 20% per annum? today Rs 1000 and next year Rs. 1200. alternately did you give them last year raise 20%?

Got it?

witty indeed.

"Population boom. Strong secular trend of urban migration."

This has already been for centuries , then what is so different this time?

The difference is that people are getting education or becoming wise like biharis and migrating to urban areas in droves. This is exponential.

Prices will never go down because

1.Black money economy

Black money can only be stored as GOLD & LAND for later usage as there is no other place to store the wealth.

Black economy does not need return on investments. Store of the wealth is high priority.

2.Job opportunities

This will increase one more decade in India till Chinese and other people learn English

When there is recession in USA and EU, Corporates will go for cost cutting and that means

more offshoring

3.NRIs and Working Families

NRI people will spend time to collect coupons for shopping cheap groceries but not when buying a home.

Both husband and wife are working and have a disposable income. This trend is increasing.

4.Pressure on white economy

Due to high inflation money is losing value very quickly.

Common man is pressured to store his wealth in GOLD or LAND

5.Owning a house is a measure of success. Everybody is doing it, I don't want to be left out.

6. People do not know the value of money.

Comparing a house in India

near a slum,

with no access to park

and no proper drainage to handle the rain

and no access to proper road to

Other countries house price is possible only for NRIs.but not for the common people.

People will compare the average price in US and India and not the amenities. This Apple to Orange

comparison blinds people

7.It will never happen to me attitude

Indians do not wear seat belts,helmets or life jackets because accident will never happen.

People have optimism as opium which blinds their eyes.

8.Real estate is where most of the blue collar jobs are available.

Govt will not let it down. you see USA is reducing the interest to 3.9 for 30 years loan

9.People who made money in Real estate is putting back their earnings to store the value

10. Only 3% of population is paying income tax. Rest all are involved in blackmoney.

Anon above:

You are the biggest choot I've seen on this blog. If US/EU go down, what would they offshore : your arse? What will happen to USD in that case and what if Rupee appreciates to 25-30 rupees/USD.

Still China and India depend on the west for thier progress and it would dtay like this for another 20-30 years.

RE in India will collapse no matter what justification you have.

@Anonymous 2:18

Let's go by your logic for argument purpose.

Today house prices in India are equal to or more than many house prices in USA. But incomes are far less than USA.

So you mentioning that house price will increase further and so will be earnings... and USA will be outsourcing earnings with lowering house prices??

Black money plays vital role, but upto some limit, once black money is absorbed you need bigger idiot with bigger black money to keep house prices increasing.

Second earner in family is huge help. But that comes with cost, and sacrifices. Indians and culture in India are not yet ready for that. Ask your NRI friends as what would they prefer.

Govt cannot bailout forever. USA tried that and we know what is happening.

I suggest you should smell coffee often.

Good Morning !

Real estate prices will never fall. Will only go up.

BUY NOW OR FOREVER BE LEFT OUT!

@ Anonymous 2:18 PM

Excellent 10 points. Very true and to the point.

No country in the world has a black economy as big as India. The President to the Peon are corrupt and we talk of Gandhian values!!!

The pillars of real estate in India are politicians irrespective of party affiliations, Industrialists, Gangsters , ranking government officers and landlords. When such strong foundation is there, the structure is unlikely to collapse. As such, those of you dreaming of drastic price drops are really hallucinating.

Bubble, china, uk, italy, greece, USA etc etc is loose talk. There is accountability in these countries. Whatever happens in those countries is not applicable to us. Why aren't we comparing India with Pakistan, Bangladesh, Zimbabwe, Niger, Sudan, Somalia etc. At least, the comparison may make sense.

I'm 27 and see no future here. If I ever get a chance to migrate, i will take that opportunity and never look back.

There is no future for this corrupt country

@8:53 PM

once black money is absorbed you need bigger idiot with bigger black money to keep house prices increasing.

Where do you think this black money starts?

1. Every day COPS are getting bribes

2. Every day RTO officers are getting bribes

3. Every day Land Regestor officers are getting bribes

4. Every day Govt officials are getting bribes (toll booth, thasiltar office .....)

5. Every day politicians are getting bribe from Govt spending

6. Every day Small business which do not want to transact more than 50k through bank happens throgh cash.

I know two business owners complaining all their clients are paying in cash

and unwillingly have more cash at home and finally put them into gold or land

7.Only 3% of the population pays income tax. My neighbour a self claimed engineer

who constructs 3-4 houses per annum has paid Rs.1000 as income tax just

to get PAN card and loan previlages. so god knows out of this 3% taxpayers how many "TOKEN" tax payers?

you sum up all the bribe money mentioned above in a day,

whole India will generate min 100 crores of black money a day. I am not a financila expert

and just guesstimating this number

Existing Black money aborbed in the form of black money. Only 20 percent is converted to white.

by Krishna

anon @ 8:53

money is not generated through bribes.

Money is just transferred.

@Jay

Banks create white money

Govt prints currency

People convert white money to black money , which I referred as black money generation

-Krishna

Major power crisis in India

http://ibnlive.in.com/news/india-faces-major-power-crisis-ahead-of-diwali/193111-3.html

Many power plants are left with 2-3 days of Coal. Welcome to 21st century India, don't forget to buy stocks of Eveready.

@Anon above - no worries black money will save us - there is enough black money to make India super power.

James Lamont of the Financial Times

"Several economists had begun to voice fears that India could return to a ‘Hindu’ rate of growth. “Far from being in a pole position among emerging markets,” he wrote, “India trails in terms of attracting foreign capital and beating inflation. Senior executives complain bitterly about Delhi’s painfully slow or inconsistent decision-making. Many local companies are focussing their investments on Africa or Latin America."

Hindu rate of growth ?????? Why hasn't BJP, RamSena, ShivSena etc etc voiced their anger

All the talk here is getting to wishful thinking.

As a realist - and a reader of this blog since its start I did buy in the 2009 slump. Today the value of my home is doubled, my loan on that property is half paid off. I only owe as much as 8 months' salary and I am just 27 years old.

I keep telling that yes prices will stagnate, bubble wont burst but deflate, prices wont fall unless there is civil unrest or war, black money or white the government knows exactly how to keep the boom going.

People who are recommending to rent should remember that renting is fine if you are single and don't need to raise a family.

But I have seen that marriage eligibility now requires you to own something tangible (house/land/car/gold) - you cannot impress someone riding a second hand Hero Honda with your 40 lakh stock portfolio in plastic bag.

The money is there to use and spend and enjoy and not to save indefinitely in a black hole hoping some day you would be able to cash it and build a palace.

Again I recommend buy only if you are going to stay (or someone you care for is going to stay) and buy only ready possession clear title property (i.e. secure a loan - the loan officers will make sure that the property is not hokey).

And buy only when ( 85% of Price <= 5 years salary if single or 2.5 yrs combined salary if both you and wife work)

@Pune mamu,

Thanks for your blah, blah, blah advise. You are a ghati and will remain a ghati throughout your life.

@American desi,

Just google the term and the wiki def. will pop out. Now, it has become a model in economics just as Einstein's e=mc2 in physics.

What india requires is rulers like moghul or british.

I am a NRI and mean no offense. Just stating the reality

- NRI -I am an NRI too - this blog was created by NRIs so stop whining. Ghati or not try buying a house in a good neighborhood anywhere in the world.

I can understand people getting frustrated but stop opposing anyone who asks people to buy.

Also calling anyone Ghati or Bihari is not going to reduce the prices.

Okay guys, seems like there are lots of emotions involved when it comes to housing. Lets discuss another pertinent question - Do you think inflation is going to fall? Why? Everybody has been hoping, including govt., that inflation falls down to 6% mark but its outta control. What say guys?

Owning a house has been a winning lottery in China too.

http://www.pbs.org/newshour/businessdesk/2011/10/chinese-housing-bubble-a-troub.html

The video does mention that rent ratios are high. Not sure if this is a bubble since most Chinese own their homes outright (ie unlevered).

@NRI

your comments are insulting and obnoxious. Having said that, i do agree that they do reflect certain reality. Semi literate and Illiterate masses in our country elect leaders like mayawati, lalu prasad, yeduveerappa, karunanidhi, chagan bhujbal etc to name a few, are responsible for this condition.

Real Estate prices may reach an affordable level only when govt clamps down on black money in such transactions. This may be a distant dream as govt's involvement in illegal activities is deep rooted and its very survival depends on black money

@Pawan

About inflation, it is difficult to predict the direction it is headed. People have lost faith in our banking system (money depreciation in real terms) and are safeguarding their earning by investing or buying assets that they think safe. Gold ane real estate are 2 safe bets.

All of the worlds currencies are pegged to the dollar, as long as America keeps printing, inflation everywhere is going to rise.

Couple that with the printing that Indian government does and you know the answer.

If you look at the history of any fiat currency in the history of human kind, all of them have ended in a inflationary spiral, sometimes replaced by another fiat currency other times replaced by currencies backed by gold or other tangible assets.

Housing never meaningfully corrects in third world countries. India, China, Brazil are not Spain, US or UK and different considerations apply. Third worlders are emotionally attached to real estate and never sell Real Estate even when economic reality justifies such. Look at what the 2 remaining countries in the Western world with a housing bubble (Canada and Australia) have in common: They are FILLED with third-world immigrants. The Chinese for example are almost singularly responsible for inflating the bubbles in Vancouver and Sydney.

In India things are further complicated by the fact that most households effectively earn first world wages (In South India for example, nearly every family has at least one NRI member working in the US, UK, Europe or the Gulf) in a third world country. Thus house buyers in India are bidding against other buyers armed with downpayments saved from living *extremely* frugally abroad. If you derive your income from domestic sources, sorry to say, but you are screwed.

Mumbai 5:32 Am

First thing in the morning I check this blog. I've not come across realistic blogs for a long time. All I see is people seeking solace in some other countries mishandling of economy.

Can we have proper date time in this blog comments so that its easy to track what are pending comments to read. I am a frequent reader of this blog and i i always felt that its good to have data time in the comments.

Thanks

Anon 7:03 AM and Samix,

If inflation is not brought under control, people will have to move into hard assets is what I think too.

Besides black money is another factor. These people are looking for inflation protection and safety than any appreciation.

I don't see how prices will come down.

Already a bleak scenario is being painted for 2012 and GDP growth numbers of anywhere between 6% to the Hindu rate (3-4%) are being projected. Inflation is sticky. Looks like we are going into anemic growth and high inflation period.

If we get there and stay there for the net half a decade (YES ITS POSSIBLE), then only hope for any respite in RE prices. However, if the above scenario pans out, people will be more worried of their jobs than think about RE.

Three factors that will keep inflation above 9%

1. Election nearby...not just in India but even in US means more free sops and money printing, delaying the inevitable.

2. Potential Iran conflict, oil will go through the 150$ barrier. Even without a war, US is looking to impose more sanctions on Iranian Oil companies

3. India could not get hold of Potash in open market this year as China outbid India, this will come back and bite next year in the form of high fertilizer prices.

What would happen to Indian RE market after US housing improves?

The main reason US market is in lull mostly because Banks have stopped lending money to prospective buyers. When there is turnaround what would be after effects on Indian RE?

US job market will improve slightly if call centers job from India move back to US but would improve tremendously when manufacturing jobs moved to USA. If this happens then China economy will be toast. The father , monther and children of all bubble (i.e. China) will not be in a position to control prices. I am wondering if this type will situation will occur soon than we anticipate.

Just Money printing is not going to solve economy problem. You should have sometime tangible where one could go, work and get paid appropriately.

Inflation is sky rocketing. It is 10% as published but much more

One meal cooked at home for 4 costs 150 rs. Rice, Daal, vegetable and pickle. It used to be 15 rs 5-6 years back. A family of 4 requires 20k per month barely to surviv. This is just for food. Then other requirements like travel, rent clothes etc

I've totally stopped worrying about buying a home. I'm living in mortal fear as such as how to survive if the inflation keeps on rising.

Hard days are ahead of us. Don't get into a debt trap woven by a bank as you will find no way out of it

@ Ashok above, earnings also have risen much more than inflation. So no worries... enjoy your life.

These days a servant earns 20K per month just by cleaning vessels and washing clothes. That is just one person per household.

You can/should:

1. Up your earnings.

2. Down your quality of lifestyle

3. Can be somewhere in between #1 and #2.

Either ways you will come out winner. Enjoy.

@ashok

http://www.tradingeconomics.com/india/inflation-cpi

Official published inflation figure is 9% . A common man with fixed income knows that this isn't true. It is much higher. Lot of essential aren't included by govt. in inflation calculation. Recent hike of petrol/diesel have affected the whole population.

If you go to any bar/restaurant in mumbai, one has to wait outside sometimes 30-40 minutes just to get inside. They are doing roaring business and an average customer spends 2000 rs for meal and drinks. These are the people with black money. police, muncipal staff, baniyas, gangsters, govt officers etc etc throng the bars. These people have not affected by inflation.

Inflation combined with corruption is slowly killing us

@Ashok

Inflation is one of the reason you should by a house now. If you keep your savings in currency, REAL inflation will eat it.

Lets say if REAL inflation is 14% and official one is 9% then bank interest will cover only the official one. but the gap (14-9=5) 5% you loose in the air. So after 15 years your currency would have lost a lot of value.

But if you convert it to HOUSE or GOLD after 20 years, value will be there but value appreciation may not be guaranteed though.

You work everyday and store your work in the FIAT Currency thinking that you can redeem it later when you want it.but unfortunately it is not that simple.

Keynesian principles do not let people hoard wealth.You have to spend it so that others can earn it.

-Krishna

found this quote from somewhere on the internet

Quit India!

Sixty years ago Indians asked the British to quit India. Now they are doing it themselves. To live with dignity and enjoy relative freedom, one has to quit India!

So true, who would not like to migrate to the west or other countries today to up their standard of living

@samix

Quit and go where. Easier said than done.

West only takes highly skilled people which may be .001% of aspiring migrants. Bhai, our destiny lies here

Even if you are earning 1lakh per month. Rs.2000 is normal if you go out to eat in any restaurant of good standard. You can take your wife to udipi everyday and still get her to fuck you when you get home.

For few it is strange that handful builders can control Mumbai realty market. On the face we see that most realty investors are Marwadi,Sindhi, Gujarati etc who buy properties in builk. I think that may not be 100% true. Major Congress folks from Western Maharashtra (popularly known as Ghatis elsewhere) have hidden hand in all property deals.It is open secret that businessmen like Wadia,Hiranandani,Bajaj are favored by Pawar.

It all started way back in 1960's when Congress guy SK Patil (Western Maha ) implemented backway reclaimation(Nariman point etc)and today again same folks from Western Maha wants to do the same. New Bombay city,Bandra-Kurla complex were mooted by the same bunch of people.

It seems all big Mumbai builders are in the pockets of Western Maha Congress politicians. And not to forget Raj Thak's investment in other builder's projects.

If one remember Mumbai realty prices were down only when BJP-Shivsena was in power in Maharashtra(and NDA in the center)

There is a tacit understanding between these people and BJP/Shivsena. They make sure Mumabi corporation remains with Shivsena's hand and they control rest of the Maharashtra.

There is definitely a political angle to the high Property rates in Mumbai(and elsewhere in MH).

An interesting tussle in real estate sector

All the time, we heard that the price of an object is determined primarily by the demand for the object relative to the supply. However, if you look at the property prices in the big cities such as Mumbai, Delhi and Bangalore, the theory seems to be failing. According to the experts in the real estate market, at present there exists very little demand for the properties. Despite this, the prices are not softening. Instead, the developers are making all efforts to hold on to the high property prices.

In the light of the tepid demand, the buyers were expecting a sharp correction in the property prices. They were also looking for a good discount in the current festive season. However, offers present in the market do not seem to be meeting these expectations at all. In the name of discount, the developers are offering some freebies such as electronic items or holiday packages. They are also offering group discounts. However, all this is way below the expectations of the buyers.

The uncertain economic environment seems to be dampening the buyer's mood as well. Interest rates are picking up. Buyers are refraining from taking loans at the prevailent high interest rates. The uncertainties in the job market are also adding to the woes. People are not very confident of their jobs. Therefore, they do not want to take on the burden of high Equated Monthly Installment (EMIs) at this moment. All this is hurting the demand in a big way.

Then why are the developers holding on to the high prices? They are doing so as they betting on the festive season for an uptick in the demand. In this season, Non-Resident Indians (NRIs) generally tend to visit India. And these NRIs tend to buy properties during this time. Therefore the developers are thinking that this would boost the demand. Any spike in demand would help them hold on to the high prices in the future as well.

This makes it an interesting tussle between property buyers and real estate developers. Who will win? Only time can answer. However, one thing is very clear that all this is hurting the real estate sector as a whole. The way inflation is persisting, it is very unlikely that interest rates would come down anytime soon. Other short term macro-economic indicators do not look very promising either. Therefore, demand would continue to remain bleak.

As a result, bad days for the real estate sector may continue for some more time.

@ashok

As someone else mentioned - save smartly. Use Gold (may be too pricey right now) or buy stocks (relatively cheaper and getting cheaper by the day). Wait for really long term - like 10 years. You may be able to afford a house. Good luck!

Read this interesting article on Realty sector in India @ http://www.businessworld.in/businessworld/businessworld/content/Unreal-Realty.html

For all the married people there's no escape, but I see no reason why bachelors should get into this trap of house-car-job, earn, save some for your parents and with the rest go see the world.

This routine of following what the society expects you to do is just another form of slavery.

Dmitry Orlov calls the house-car-job dependency as the Iron triangle. I would say that a job is a necessity not just for money but also to keep your sanity, a house and a car are not really necessary if you think about it.

Maybe one ancestral house for bad days will suffice.

Get a life peoplee.

Great links thanks! This will be my good guide ;)

By using BullionVault you are able to obtain physical precious metals by the gram at current exchange prices.

Register your free account today and get 4 g's in free silver as a welcome bonus.

Thanks for sharing nice information with us!!

BramhaCorp is one of the Top Real Estate Developers in Pune well known for their unique flats in Pune.

Thanks for sharing the information it helps a lot. If your searching for Open plots and Luxury villas for sale in Hyderabad. JJ Infra is the No.1 Real estate company for Investments

Post a Comment